The public issue of equity shares of HARSHA ENGINEERS INTERNATIONAL LIMITED will open for subscription on September 14, 2022 and closes on September 16, 2022. It is expected to list on the stock exchanges on September 26, 2022. What does the company do? Why is the company going public? Who are its key competitors? Its key strengths, and lot more. Here’s everything that you want to know about the company to analyse the IPO.

Company Profile

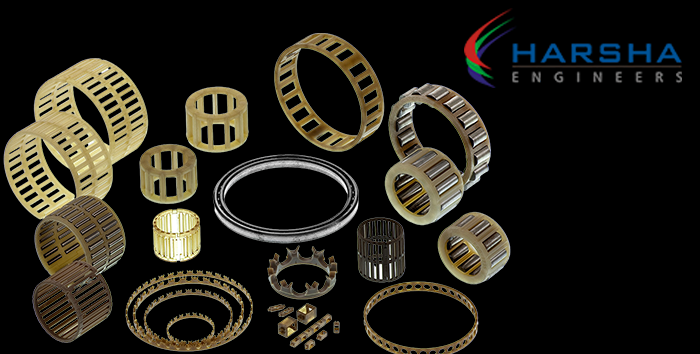

Established in 2010, it is the largest manufacturer of precision bearing cages, in terms of revenue, in the organized sector in India, is among the leading manufacturers of precision bearing cages in the world. The company manufactures a wide range of bearing cages starting from 20 mm to 2,000 mm in diameter, and their bearing cages find its application in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewables sectors, etc.

Harsha engineers have four strategically located manufacturing facilities for their engineering business, with one of their principal manufacturing facilities at Changodar and one at Moraiya, near Ahmedabad in Gujarat in India, and one manufacturing unit each at Changshu, China and Ghimbav Brasov in Romania. The company supplies products to customers in over 25 countries covering five continents.

The company has approximately 50-60% of the market share in the organized segment of the Indian bearing cages market and 6.5% of the market share in the globally organized bearing cages market for brass, steel, and polyamide cages in CY 2021.

The company business comprises:

-

Engineering Business Under this they manufacture bearing cages (in brass, steel, and polyamide materials), complex and specialized precision stamped components, welded assemblies, brass castings & cages, and bronze bushings.

-

Solar EPC Business Under this the company provides complete comprehensive turnkey solutions to all solar photovoltaic requirements.

Who are the Promoters of the Company?

Rajendra Shah, Harish Rangwala, Vishal Rangwala and Pilak Shah

Why is the Company going public?

Given below are the objectives of the Company –

The Offer comprises a Fresh Issue by the company and an Offer for Sale by the selling shareholders. The company will not receive any proceeds from the Offer for Sale.

The Company proposes to utilise the Net Proceeds from the Fresh Issue towards funding the following objects:

-

Pre-payment or scheduled repayment of a portion of the existing borrowing availed by the Company

-

Funding capital expenditure requirements towards purchase of machinery

-

Infrastructure repairs and renovation of existing production facilities including office premises in India

-

General corporate purposes

Don’t have Wealthstreet account? No worry, just go to our IPO platform, create a guest login and apply for the IPO easily! Click the “Apply Now” button below.

Apply online in just 5 minutes!

Apply Now Investment in securities market is subject to market risks, read all the related documents carefully before investing.

079-66775500

079-66775500 welcome@wealthstreet.in

welcome@wealthstreet.in A-1101, Mondeal Heights,

S.G. Highway, Ahmedabad - 380015

A-1101, Mondeal Heights,

S.G. Highway, Ahmedabad - 380015