The Ascent of ETFs in India: A 21-year Retrospective!

A brief history of evolution of ETFs and rapid growth of ETFs market in India.

Exchange-traded funds (ETFs) have come a long way in India since the launch of the country's first ETF, Nifty BeES, in 2001. On 28 Dec 2022, ETF industry completed 21 years and have become increasingly popular among investors in India due to their convenience, diversification, and low costs.

What are ETFs?

ETFs are hybrid investments with the combined characteristics of stocks and mutual funds. They trade on exchanges like a stock and invest in a portfolio of stocks, bonds, commodities, or any other tradable investment avenues, like mutual funds. However, unlike mutual funds, they have higher liquidity, lower expenses, and transparency. These ETFs are mostly passive funds, the portfolio of which resembles a selected benchmark index.

The continuous pricing and liquidity throughout the trading day means that ETFs can be pledged, lent, or subjected to any other strategies used by equity investors.

Evolution of ETFs

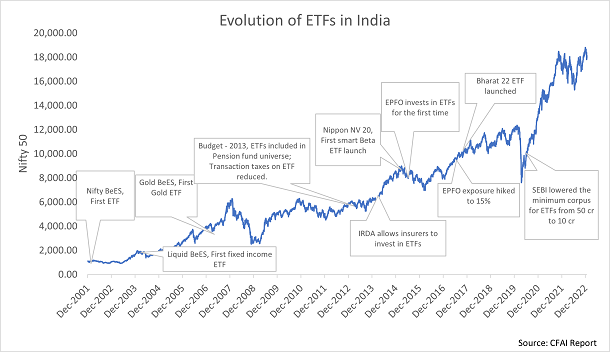

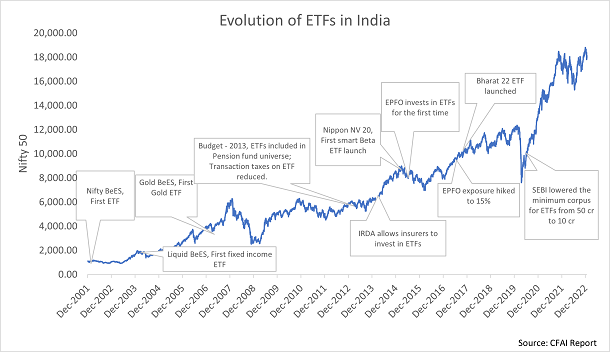

Although ETFs were first introduced in India by Benchmark Asset Management in 2001, with the first offerings being in equity and subsequently in the money market and gold, the industry was initially dominated by gold ETFs. However, a major reform in budget 2013, which included ETFs as an eligible asset in the pension fund universe and reduced securities transaction taxes to be in line with mutual funds, helped to boost the popularity of ETFs in India. The government’s divestments from public sector enterprises through the CPSE ETF route also helped to increase investor awareness and assets in ETFs.

From a small asset base of INR 1,692 crore in Jan 2013 representing 12.5% of overall ETF assets, other ETFs (mostly equity) grew more than twice to INR 6,702 crore by the end of 2014 or 48% of overall ETF assets. As of Nov 2022, other ETFs (mostly equity) accounted for 96% of the total assets in the ETF industry in India.

Nippon India ETF Nifty 50 BeES (Nifty BeES), India’s first-ever ETF scheme, achieved a milestone of Rs 10,000 crore in Assets Under Management (AUM) recently. Nifty BeES is the third largest Nifty 50 ETF in the country, with SBI Nifty 50 ETF (approx. INR 1.5 lakh crore) and UTI Nifty 50 ETF (INR 41,000 crore) ranking as the first and second largest, respectively. While the latter two ETFs have primarily grown their AUM through inflows from the Employees' Provident Fund Organization (EPFO), Nifty BeES has primarily gained its assets from retail and high-net-worth individual investors.

In 2015, ETFs in India received a significant boost in popularity when the Employees Provident Fund Organization (EPFO) began exploring opportunities for investing in the stock market through ETFs. Initially, EPFO invested a modest 5% of incremental flows in ETFs, but later increased this amount to 15% in 2017. This decision helped increase the visibility and attractiveness of ETFs among investors.

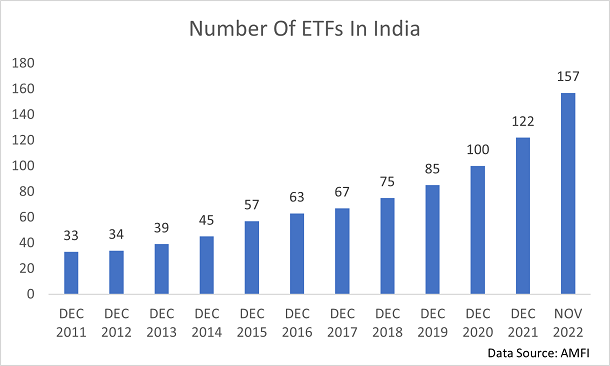

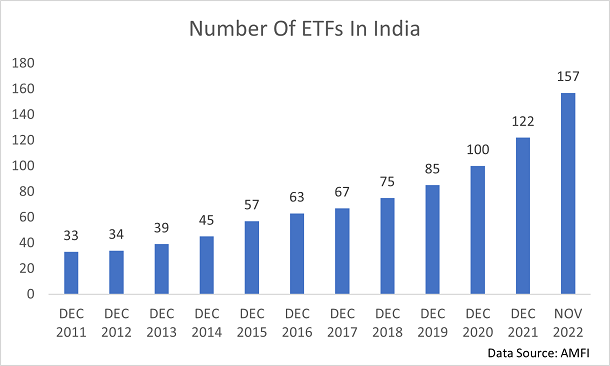

The number of ETFs in India has grown steadily over the past decade, with over 150 ETFs available on the market as of November 2022. Most of these ETFs track major indices such as the Nifty 50 and the BSE Sensex, although there are also sector-specific and thematic ETFs available.

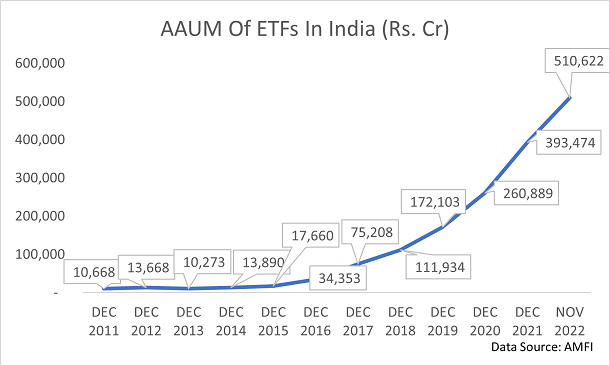

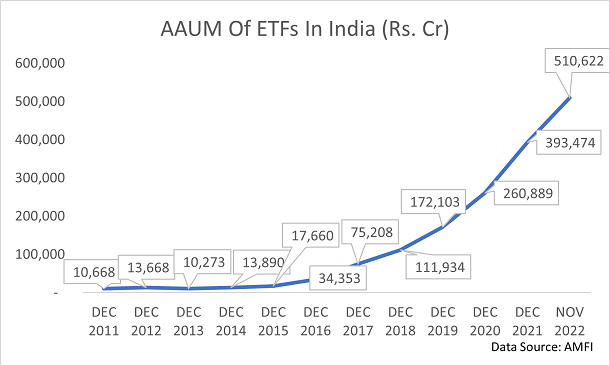

In terms of assets under management, ETFs in India have seen significant growth in recent years. As of November 2022, the AUM of ETFs in India stood at INR 5.11 lakh crore, 29.77% up from INR 3.93 lakh crore in December 2021. Passive equity funds in India, which are dominated by ETFs, had a market share of 14.3% of overall mutual funds’ assets and has been experiencing steady growth.

ETFs Status Quo: India vs US

Number of ETFs

As of November 2022, there were over 150 ETFs listed on Indian exchanges, while there were over 3000 ETFs listed on U.S. exchanges.

AUM

As of November 2022, ETFs in India had a total AUM of over INR 5.1 trillion (approx. $62.5 billion), while ETFs in the United States had a total AUM of over $5.9 trillion.

Market share

ETFs in the United States account for a significant portion of the mutual fund market, with 21% of all mutual fund assets in the country at the end of 2021. In contrast, ETFs in India make up a smaller portion of the mutual fund market, around 11.67% of all mutual fund assets in the country as of November 2022. This clearly signifies there is significant headroom available for growth of ETFs market in India.

Range of products

The ETF market in the United States is significantly larger and more diverse than in India, with a much wider range of ETFs available. In the United States, ETFs track a wide range of indices, sectors, and asset classes, including stocks, bonds, commodities, and real estate. In India, the range of ETFs is more limited, with most ETFs tracking domestic indices, such as the Nifty 50 and the BSE Sensex.

Growth Drivers

The convenience and cost-effectiveness of ETFs compared to other investment options is a major factor driving their growth. ETFs generally have lower expense ratios compared to actively managed mutual funds, making them a cost-effective investment option.

The introduction of thematic ETFs, which focus on specific themes or sectors, has also contributed to the growth of the ETF market in India. These ETFs allow investors to gain exposure to specific sectors or themes, such as technology or infrastructure, without having to invest in individual stocks.

Another factor contributing to the growth of ETFs in India is the increasing popularity of passive investing. Many investors are opting for low-cost, index-tracking options such as ETFs over actively managed funds, which can be more expensive and may not outperform the market.

Conclusion

The ascent of ETFs in India has been marked by steady growth in both the number of ETFs available and the assets under management. With increased investor awareness, the convenience and cost-effectiveness of ETFs, and the introduction of thematic ETFs, it is likely that we will see continued growth in the ETF market in India in the coming years.

079-66775500

079-66775500 welcome@wealthstreet.in

welcome@wealthstreet.in A-1101, Mondeal Heights,

S.G. Highway, Ahmedabad - 380015

A-1101, Mondeal Heights,

S.G. Highway, Ahmedabad - 380015